What is Your Home?

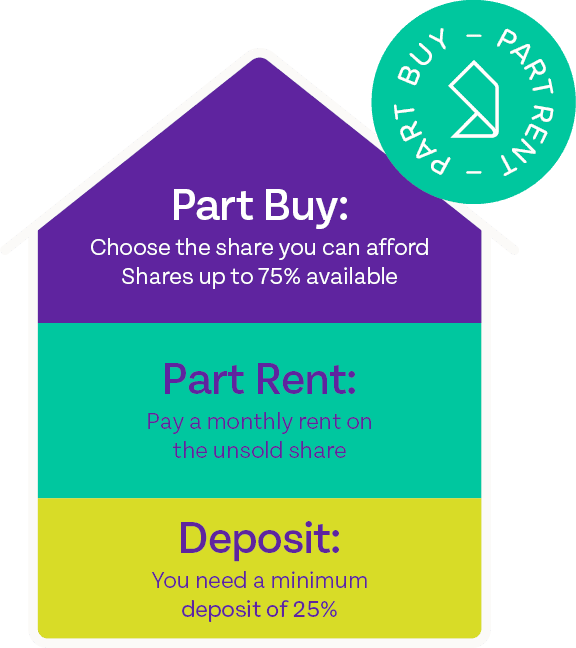

How does Your Home work?

Example

Buying a minimum 25% share of a £250,000 home with Your Home would work like this:

Cash deposit of 25%

£62,5000

Your Home will invest 75%

£187,500

You pay a monthly rent on the 75% that you don't buy

£920.30 per month

Who is eligible?

We're doing away with income restrictions and limits on what kind of property you can purchase to offer a gradual homeownership solution that caters to the movers and shakers out there.

As long as you are buying a property* available on the second-hand market as a freehold, and you plan to live in it as your main and only residence – Your Home can expand your opportunities.

For now and for the future

With gradual home ownership, many people find themselves in the position of looking for the homes they truly want, not what they can afford outright.

Like with a mortgage, you will pay a fixed monthly amount. This is your rent and is paid on the percentage of home that you have not bought through your initial share. Unlike a mortgage, the rent is linked to inflation through the Retail Price Index (RPI), not interest rates.

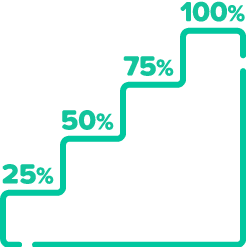

As your personal income and savings grow over time, you're free to up the percentage of the property that you own, gradually increasing your initial share and decreasing the percentage you pay rent on.

Pick a freehold property that's on the market*

No more looking at certain new builds in a particular development. With Your Home, the choice of home is yours.

Search the market, speak to estate agents, view the properties you want*.

Benefit from the increase in value

If you sell the property you will receive to the full value of the share you own including your portion of any increase in the properties value – potentially helping you reach that next rung on the property ladder.

Increase your share at your pace

You can buy more – or all – of the property after you've lived in it for 12 months, this process is known as staircasing.

Whether you're just getting started on the property ladder, or you're considering a step up. Your Home offers a product designed to expand your choices.

* The home must be a freehold property that is at least one-year old and have an EPC rating of at least D. A RICS Level 2 Home Buyers Report must be completed at the expense of the buyer (prior to exchange), the valuation must be in line with the purchase price agreed. There must be no serious safety issues highlighted or anything that could cause severe long-term damage for the buyer or the property (eg. damp, mould or subsidence).